First Bank Restricted Company’s Account Because of SCUML. 3 Years Later, SCUML Is Ready but Account Isn’t Reactivated

Tunde Oyeniran, the chief executive officer of Ekini White Tulip Consulting Limited, has expressed his frustration over the failure of First Bank to lift a restriction placed on his company’s account since 2021.

In 2021, the bank restricted the account of Oyeniran, whose company is a customer of the bank, without any communication on what prompted the action.

Upon enquiry, the bank told him that he failed to submit a special control unit against money laundering (SCUML) certificate. But the CEO said that the bank never informed him that it was a requirement when he opened the account in August 2020.

In the course of making efforts to have the restriction removed, a client innocently paid N160,000 for a consultancy service into the account. Up till now, the company has not been able to transfer the money out of the account.

Despite the restriction, the bank kept sending monthly statements of account to the company’s account number without showing there was any active restriction on it.

In July, Oyeniran’s tortuous journey towards acquiring the SCUML clearance certificate, a document the Economic and Financial Crimes requires Designated Non-Financial Institutions in Nigeria (DNFIs) to possess to check inflow and outflow of funds against illicit activities, paid off.

“The bank assured me that the restriction would be lifted promptly once I presented the SCUML certificate. Between 2021 and July 2024, I made numerous attempts and applications to obtain the certificate, finally acquiring it in July 2024,” Oyeniran, a Lagos-based consultant, said.

“On July 17, 2024, I presented the SCUML certificate, expecting my highly disvalued funds to be released immediately. However, this did not happen. It has waste of time, lack of care, insensitivity, cover-ups and shenanigans.

“The first obstacle was that the account had become dormant. To reactivate it, I was required to fill out three forms and submit a passport photograph. Despite completing these steps, the account reactivation was not straightforward. At that point, I was told it would take 14 days for the account to be reactivated.”

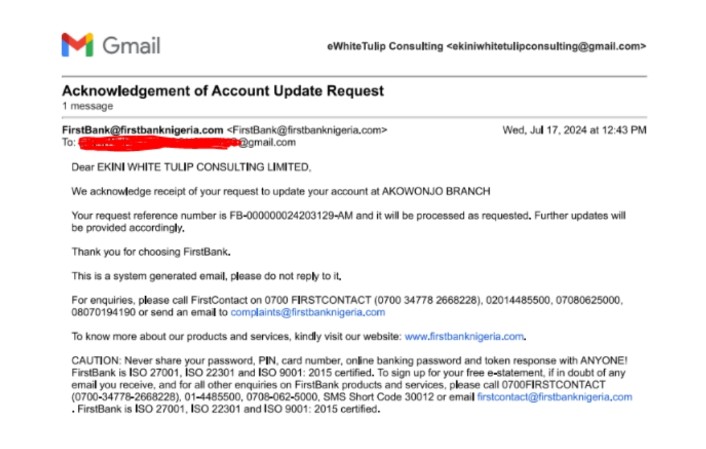

But before the 14-day period given by an official at Akowonjo branch of the bank elapsed, the company received an email stating the account had become operational.

“I received an email confirming that my account was active as of July 17, 2024, two days after filling all the forms for reactivation, something a customer relations officer at Akowonjo said would take 14 days.”

The company’s expectation of accessing the account and the money trapped in it was disappointedly extended by the bank with a claim that it was doing a software migration.

The bank then claimed that were some inconsistencies in the company’s registration details with the Corporate Affairs Commission (CAC). This is despite the fact that, as a requirement, the bank had collected N10,000 to verify the the company’s registration details at the point of creating the account in 2020. This, according to Oyeniran, suggests the bank only collected the money without conducting any verification in the first instance.

“Despite the account been active, the bank claimed they could not upload the SCUML certificate due to migration to a new banking software between 2021 and 2024.

“After a lot of back-and-forth and vexatious time-wasting, the bank stated they were experiencing problems and are unable not upload the certificate. I escalated the matter from the customer relationship officer to a supervisor and then to the bank manager. The situation only worsened after I escalated it.

“Another phantom hurdle was again erected. The bank then claimed there were discrepancies in the documents submitted to the CAC, questioning the validity of my company registration. I am at a loss as to how they became regulator of CAC. And I have used the same documents to open accounts at other banks without issue before and after I opened this particular account.

“The bank officials at Akonwonjo have since abandoned our conversation and any effort at resolution.”

An email sent to the bank’s complaints management unit via its email address ([email protected]) posted on its website bounced back twice on Tuesday, indicating that the email address was invalid.

https://fij.ng/article/first-bank-restricted-companys-account-because-of-scuml-3-years-later-scuml-is-ready-but-account-isnt-reactivated/